The Financial Market and the Capital Market

The financial market in Poland is a broad system that includes banks, insurance, pensions, payments and the capital market.

The capital market is a key part of this system – it focuses on trading securities, investment funds, commodity exchanges and related services.

Who Supervises the Capital Market in Poland?

In Poland, supervision over the capital market is carried out by the Polish Financial Supervision Authority (Komisja Nadzoru Finansowego – KNF).

KNF acts as the central body responsible for making sure the market works fairly, safely and transparently.

Legal Basis of Supervision

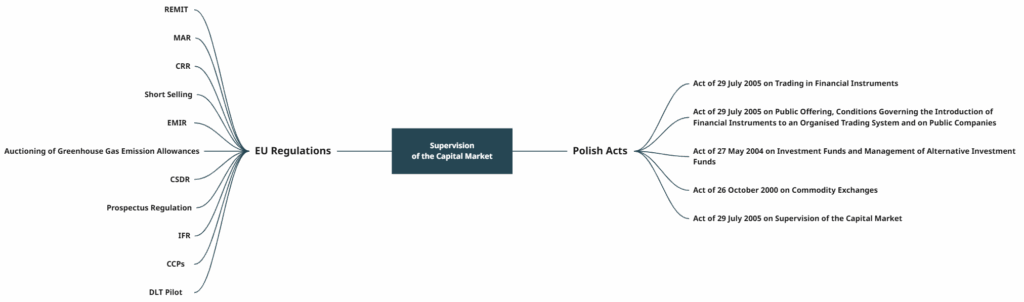

Supervision of the Polish capital market is carried out by the KNF under both national laws and EU regulations, combining domestic rules with European standards.

Supervision of the capital market covers the following Polish acts:

- Act of 29 July 2005 on Trading in Financial Instruments

- Act of 29 July 2005 on Public Offering, Conditions Governing the Introduction of Financial Instruments to an Organised Trading System and on Public Companies

- Act of 27 May 2004 on Investment Funds and Management of Alternative Investment Funds

- Act of 26 October 2000 on Commodity Exchanges

- Act of 29 July 2005 on Supervision of the Capital Market

…and EU regulations:

- Regulation (EU) No 1227/2011 on wholesale energy market integrity and transparency (REMIT) – in relation to financial instruments

- Regulation (EU) No 596/2014 on market abuse (MAR)

- Regulation (EU) No 575/2013 on prudential requirements for credit institutions (CRR)

- Regulation (EU) No 236/2012 on short selling and credit default swaps

- Regulation (EU) No 648/2012 on OTC derivatives, central counterparties and trade repositories (EMIR)

- Commission Regulation (EU) No 1031/2010 on auctioning of greenhouse gas emission allowances

- Regulation (EU) No 909/2014 on securities settlement and central securities depositories (CSDR)

- Regulation (EU) 2017/1129 on the prospectus to be published when securities are offered to the public (Prospectus Regulation)

- Regulation (EU) 2019/2033 on the prudential requirements of investment firms (IFR)

- Regulation (EU) 2021/23 on a framework for the recovery and resolution of central counterparties (CCPs)

- Regulation (EU) 2022/858 on a pilot regime for market infrastructures based on distributed ledger technology (DLT Pilot)

Who Is Supervised?

Supervision of KNF covers a wide range of market participants:

- Investment firms

- Agents of investment firms

- Custodian banks

- Companies operating a regulated market

- The National Depository for Securities (KDPW S.A.)

- Companies operating a clearing house

- Companies operating a settlement house

- Companies entrusted with depository or settlement tasks by KDPW S.A.

- Central securities depositories

- Issuers of securities

- Investment funds

- Investment fund management companies

- Alternative investment fund managers (AIFMs)

- Service providers for investment funds and alternative funds

- Companies operating commodity exchanges

- Commodity brokerage houses

- Foreign legal entities conducting commodity brokerage in Poland

- Clearing houses of commodity exchanges

- Central counterparties (CCPs)

- Financial counterparties

- Financial holding companies based in Poland

- Investment holding companies based in Poland

- Mixed financial holding companies based in Poland

- Mixed-activity holding companies based in Poland

- Emission allowance market participants

- Approved publication arrangements (APAs)

- Approved reporting mechanisms (ARMs)

- Benchmark administrators

- Crowdfunding service providers

- State-owned banks conducting brokerage activities

In practice, anyone who wants to raise capital or invest in Poland operates under the KNF’s eye.

Powers of the KNF

KNF fulfils its role through licensing, regulatory, control and disciplinary functions.

It grants authorisations to banks, insurers, pension and investment funds and other financial institutions.

If rules are breached, KNF may impose fines, withdraw licences or issue recommendations to individual entities or the wider market.

It also monitors regular reports from supervised institutions to check compliance with capital and legal requirements.

In urgent cases, it can enforce immediate measures to protect the market and investors.

Cooperation with Other Institutions

At the same time, KNF does not work in isolation.

It cooperates with the European Securities and Markets Authority (ESMA), the European Commission, and regulators in other EU countries, exchanging information and aligning standards.

It also works with domestic authorities such as the Ministry of Finance and the National Bank of Poland.

An important part of this cooperation is anti-money laundering (AML) and counter-terrorist financing (CTF), where KNF works closely with national and European institutions to ensure that the financial system is not misused for illegal activities.

Conclusion

In short, KNF is the guardian of the capital market in Poland.

Its role is to balance two things: allowing the market to grow and innovate, while making sure it remains stable, transparent and trustworthy.